Frequently Asked Questions

The 1Plus1 Loans™ frequently asked questions. If you have a question and it is not answered on this page then please do not hesitate to ask. Simply email your question to ask@1plus1loans.co.uk and we will answer directly to you and add it to this page for everyone else to view.

A Non-Guarantor loan means you don’t need someone else to agree to pay if you can’t. If you make your payments on time, you get lower interest rates. It’s simple and easy to understand.

Your loan starts with an interest rate of 39.9% APR. If you make six consecutive monthly payments on time, your rate drops to 37.2% APR. Make another six consecutive monthly payments on time, and it goes down again to 34.5% APR – this is the final rate reduction. The number of rate reductions will vary depending on the term of your loan.

The rate will be reduced when you meet the milestone of making six consecutive monthly payments in full and on time, without any defaults. How often this happens depends on the term of your loan for example, one reduction in 12 months and two in 24 months. This reduction happens as long as you keep up with on-time payments. We won’t increase the rate if you miss a payment.

Yes, if you qualify for a lower rate, we will update your monthly payments based on the new, lower rate.

There are no fees for applying or paying off your loan early. However, there is a late fee if you miss a payment, and we'll tell you this amount in your loan agreement.

We will automatically lower your rate, and we will send you an email to let you know.

If you miss a payment, pay less than the full amount due, or pay four or more working days late, it resets your progress towards the next Milestone. You will then need to start a new sequence of six consecutive monthly repayments in full and on time to qualify for a rate reduction.

We know it can be disappointing if your loan was not accepted. Here are some reasons why this might happen:

Credit Score: Your credit score might be too low. This can happen if there were problems with payments before, or if you have a lot of debt.

Application Details: Mistakes or missing information can lead to a decline.

Income: Your income might not be enough for the loan you want.

Financial Situation: We check to make sure you can pay back the loan.

If your application was declined, it can help to check your credit report. You can also try to improve your credit score. For free help, you can contact Stepchange , Citizens Advice or Moneyhelper. Credit agencies like Experian, Equifax, and TransUnion can also give tips to improve your score.If you have questions, email us at info@1plus1loans.co.uk

Taking a payment holiday or entering a payment plan pauses your progress toward the next milestone and interest rate reduction. If you miss a payment, pay less than the full amount due, or pay four or more working days late, it resets your progress towards the next milestone. You'll need to start over with six consecutive on-time payments to qualify for a rate decrease.

You can apply if you live in the UK, are aged 18 to 70, earn at least £1,500 a month (after tax), and have a job or receive benefits. We’ll check to make sure you can afford the repayments.

We’ve made sure that all details about your loan are clear from the start. You'll receive information on how and when your rates might decrease, and we'll keep you updated with straightforward communications to ensure you have all the support you need. If you need any help, contact us ask@1plus1loans.co.uk, our team will be happy to answer any questions and provide support.

If you’re struggling to pay, don’t worry, we won’t increase your interest rate. We can offer different ways to help you with payments and give you support if you’re having money problems. You can contact us on 0330 1200 313

It’s easy to apply. Just visit our website and click "APPLY", or call our customer service team on 0330 1200 313. The process is simple, and we will let you know if you need a guarantor.

Here are the key benefits:

- Lower interest rates if you pay on time.

- We won’t raise your rates if you miss a payment.

- We help you focus on improving your credit score and money management.

- Simple and clear communication throughout your loan.

A guarantor loan is a loan where a friend or family member agrees to pay if you can’t. This person is called a guarantor. Here’s how it works:

- You apply for the loan: You fill out an application just like with any other loan.

- Your Guarantor co-signs: Your guarantor, who should have a good credit history and stable finances, also signs the loan agreement.

- You receive the money: Once approved, the loan amount is deposited into your guarantors account.

- You make the payments: You make regular monthly payments to repay the loan.

A guarantor is required by law to pay back the loan if the borrower doesn’t. This means they might have to pay any missed payments and future payments until the loan is fully paid. This could affect their credit score, and if the loan isn’t paid, they might have to pay late payment fees and face legal action.

A guarantor is someone, like a family member (not your husband, wife, or partner) or a friend, who agrees to help you get a loan. They promise to pay back the loan if you can’t. This makes it easier for people with low or no credit history to get a loan.

Being a guarantor is a big responsibility. If you miss payments, they are responsible for making them. They are agreeing to take on your debt if you can’t pay, so they need to be sure they can afford it.

A guarantor is usually someone you trust, like a family member or friend, who has good credit and a steady income. They need to be over 21 years old and able to afford the loan payments if you can’t. Common guarantors are parents, grandparents, brothers, sisters, other relatives, and friends. Your guarantor cannot be your husband, wife, or partner.

It’s important to talk to your guarantor about why you need the loan and make sure you can pay it back. It's important that they understand that if you can’t make the payments they will have to pay, which could affect their own finances and credit score.

A guarantor is required by law to pay back the loan if the borrower doesn’t. This means they will have to pay any missed payments and future payments until the loan is fully paid. This could affect their credit score, and if the loan isn’t paid, they will have to pay late payment fees and face legal action.

To be a guarantor, you must meet these requirements:

- Be at least 18 years old, but no older than 70 when the loan ends. If you’re not a homeowner, you need to be at least 21.

- Live in the UK (but not in the Isle of Man or Channel Islands).

- Be a homeowner or a tenant with a good credit record.

- Have a UK bank account and a valid UK debit card.

- Have a good credit history.

- Not be under an Individual Voluntary Arrangement (IVA) or a bankruptcy order.

- Make sure you can afford to pay the loan if the borrower can’t. This is important so you are ready to help if needed.

- You cannot be the borrower’s partner or spouse.

Being a guarantor means you are taking on extra financial responsibilities for the full term of the loan. If the person you’re helping misses a payment or can’t pay back the loan at any point, you will have to make those payments. This could affect your credit score and your finances.

If you can’t make the payments either, we might have to take legal action against you and may charge you late fees. This could lead to serious problems like court judgments or even bankruptcy. It’s very important to understand these risks and make sure you can afford to help for the full term of the loan before agreeing to be a guarantor.

If you are a guarantor, you can help a friend or family member get a loan to:

- Improve their credit score

- Manage their money if they can’t get a loan on their own

Before you decide, it's important to know that being a guarantor means taking on risks. You will have to pay back the loan if the borrower can’t. This could affect your credit score and might even lead to legal action if payments aren’t made.

You have the right to cancel the Agreement within 14 days from the date we sign it. Any money lent to you must be repaid immediately upon cancellation. If you wish to cancel, please contact us as soon as possible at info@1plus1loans.co.uk.

You might need a guarantor if you have bad credit or no credit history at all. If that's the case, we will work with your chosen guarantor to assess their financial situation.

Your guarantor might have been rejected for a few reasons. Before you send their details, make sure they meet these requirements:

- They must live in the UK.

- They need to have a good credit score.

- They must be over 18 and under 70 years old when the loan is fully paid back.

- They agree to be responsible for the loan if you can’t pay.

If your guarantor has a poor credit score, they will be rejected, and this will slow down your application because you’ll need to find a new guarantor.

Guarantors who are tenants must have at least 3 years on the electoral roll, a good income, and a credit history with no missed payments.

If you send us three guarantors who don’t meet our requirements, we will cancel your application.

No, we do not charge you a fee to apply.

If a broker sends your loan application to 1Plus1, they charge us a fee. This fee is paid by 1Plus1 and does not affect the cost of your loan. Your loan payments will be the same whether you came through a broker or not. If someone asks you to pay an upfront fee, it is likely a scam. 1Plus1 does not work with any brokers who charge upfront fees.

We’re sorry, but we cannot approve your application if you are currently in an Individual Voluntary Arrangement (IVA)

We’re sorry, but we can’t offer loans to people who are currently bankrupt.

You can repay your loan in full at any time without any additional charges. Simply clear the remaining balance on your account. To do so, please call us at 0330 1200 313, and we will help you settle your account. You can make the payment by card or bank transfer.

You can change your payment date once in a 12-month period. To do so, please provide 14 days' notice. Just call us at 0330 1200 313, and we'll help you with the change.

We’re sorry, but we don't accept partners or spouses as guarantors.

Absolutely! They can apply to be your guarantor. As long as they have a good credit rating, and the loan is affordable for the term requested, we'll consider their application.

No, but being on the Electoral Role can help speed up the process. If you’re not on it, we’ll need to confirm your identity in other ways, which might take a bit longer. However, your guarantor does need to be on the Electoral Role.

If you're not happy with something, we want to make it right. Give us a call or drop us a line and let us know what's wrong. For more information, please visit our Making a complaint page, We're here to help!

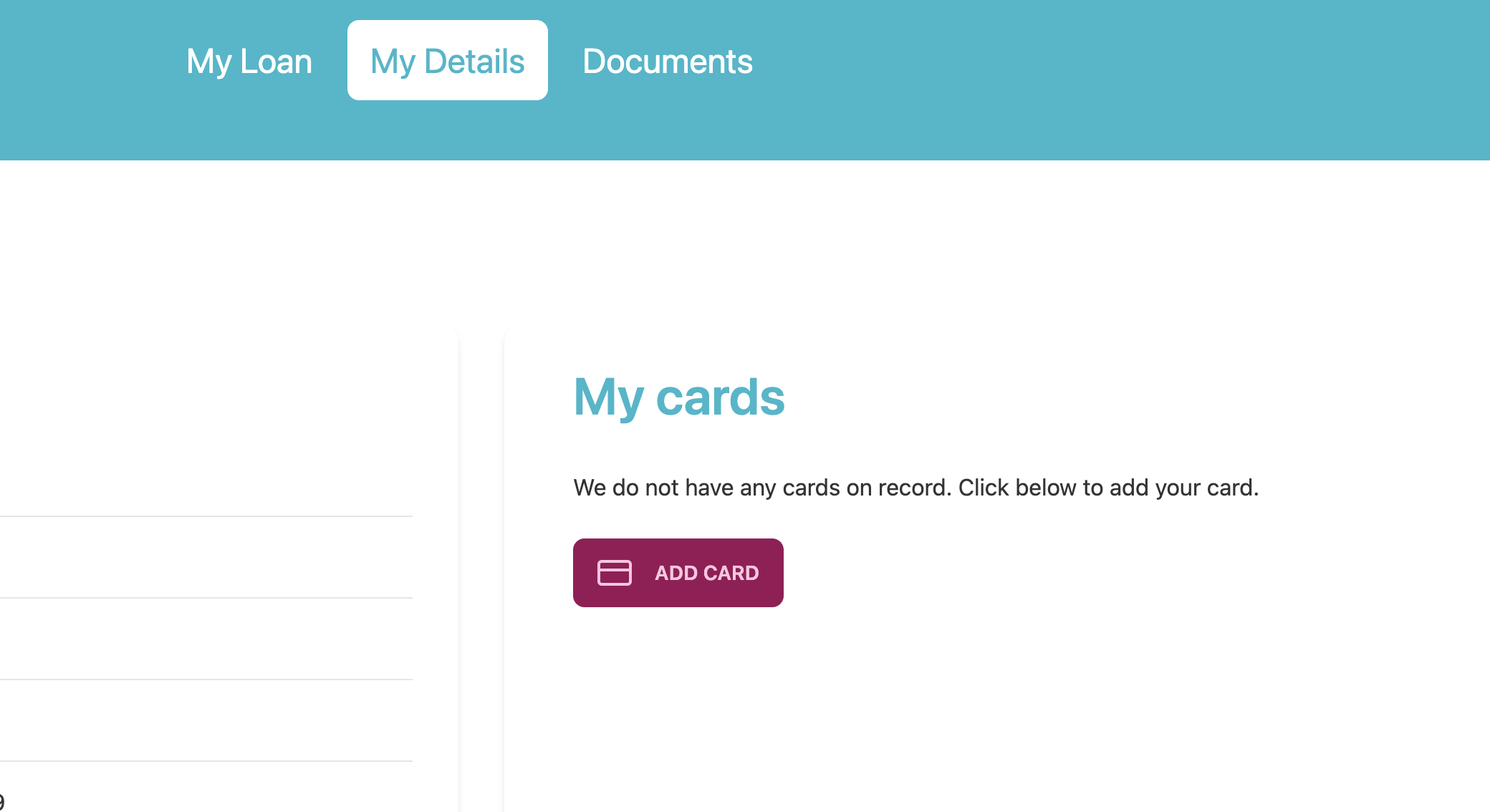

Please log in to your account. At the top, you'll see a message prompting you to add a new card. Simply follow the on-screen instructions, and your new card will be added seamlessly.

If a borrower misses a payment, we will send text and email alerts. If the loan has a guarantor, they will get an alert too. Our first step is to talk to the borrower to find out why the payment was missed. We will always try to work with them to find a solution before we contact the Guarantor.

If we can’t reach the borrower or the payment still isn’t made, we will try to take the payment from their debit card. For loans with a guarantor, if this doesn’t work, we will use the Continuous Payment Authority (CPA). This means we have permission to take the payment from the guarantor’s card. If both tries fail, a late fee might be added, and we will send a letter to the borrower, and the guarantor if there is one.

If you get an alert, we suggest you contact the borrower to find out what happened and reach out to us. If you know the borrower is having trouble, you can log in and make a payment online to cover the missed amount before a late fee is added or the loan goes into default.

If the loan goes into default, the borrower (and guarantor, if there is one) will get a notice. There will be 14 days to pay back what is owed. On the 15th day, we will use the CPA to try to take the payment from the guarantor’s card (if there is one) or take other steps to get the money.

Once the payment is made, we will send text and email updates to the borrower and the guarantor, if there is one.

If you think you might miss a payment, please tell our team as soon as possible, we're here to help. Missing payments can make it harder to borrow money or get things like a mobile phone plan. You can also ask for help from the charities below.

You can pay by Direct Debit, Debit Card, Bank Transfer, or Standing Order.

Debt Advice Charities:

| Step Change | www.stepchange.org | 0800 138 1111 |

| National Debt Line | www.nationaldebtline.org | 0808 808 4000 |

| Money Helper | www.moneyhelper.org.uk | 0300 500 5000 |

If you paid a fee to another company, it’s likely because they helped you find lenders. Please talk to that company about the fee. We don’t charge any fees to apply, and we can’t take fees out of your loan.

Our emails might end up in your Spam or Junk folder. These folders sometimes block links to keep your computer safe. To fix this, move our email to your Inbox and mark it as “Not Spam” or “Not Junk.” You can also add our email address to your safe list so you don’t miss any important emails in the future.

If you make an extra payment by mistake with your debit card, we will refund the extra amount within five working days to the same card or account. If you ask for a refund after your payment was due, there will be a £5 fee. Any extra money on your account can be refunded if you ask, or it will be used to pay off your loan at the end.

Unfortunately, we do not currently offer loans to residents of the Channel Islands. We apologise for any inconvenience.

No, we do not sell or provide Payment Protection Insurance (PPI) with our products. You may be able to obtain PPI from a specialist company, but not from us.

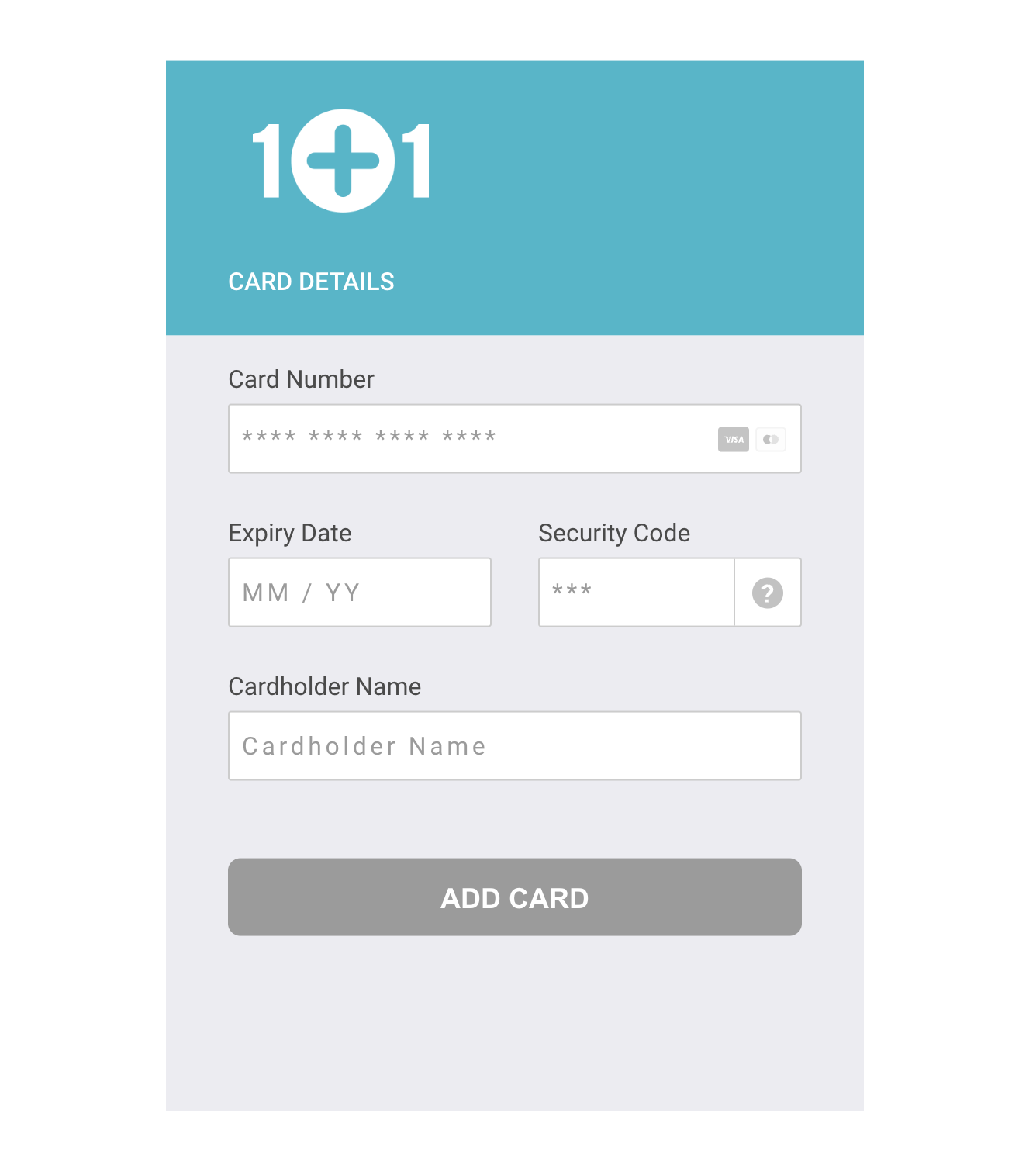

Step 1. Follow the link in your email to log into your account.

Step 2. Click my details then the Add Card button

Step 3. Enter your card details and press the add card button. This is a safe and secure method.

Once a loan has been approved for payout, we will transfer the funds to the guarantors bank account for them to pass to the customer. If there is no guarantor, the loan will be paid to the customer.

The information we collect about you is used to assess your ability to act as a guarantor, and, in the event of default by the customer, to make collections from you. With your consent, we may also use this information to send you marketing materials. We may share your information in certain limited circumstances.

In relation to your obligations under this Guarantee and Indemnity Agreement

-

We may disclose a copy of this Guarantee and Indemnity Agreement to the Debtor if requested at any time or in accordance with our obligations under the Consumer Credit Act 1974 or otherwise in accordance with our responsible lending policies.

-

We may also disclose other information relating to this Guarantee and Indemnity Agreement to the Debtor. This includes, but is not limited to, disclosing statements relating to any repayments you have or have not made on the Debtor's behalf, or any correspondence we have had with you in relation to your obligations under this Guarantee and Indemnity Agreement. By entering this Guarantee and Indemnity Agreement, you agree that we may do so.

-

In considering whether to enter into this Guarantee and Indemnity Agreement we may search your record at credit reference agencies. By entering this Guarantee and Indemnity Agreement, you agree that we may do so. They may add details of our search and your request to be Guarantor of the Loan Agreement to their records about you. This will be seen by other organisations that make searches. Our search of records at credit reference agencies may be linked to your spouse/partner or other persons with whom you are linked financially. For the purposes of any application or this Guarantee and Indemnity Agreement you may be treated as financially linked and you will be assessed with reference to "associated records".

-

We may also add to your records with the credit reference agencies details of your Guarantee and Indemnity Agreement(s) with us, if you are required to make any payments the payments you make, any default or failure to keepto its terms. These records will be shared with other organisations and may be used and searched by us, and them, in order to:

-

consider applications for credit in the capacity as a borrower, to be a guarantor or indemnifier in the future, and other credit related services such as insurance for you and any associated person;

-

prevent or detect money laundering and fraud;

-

trace debtors or recover debts; and

-

manage your accounts.

-

-

It is important that you provide us with accurate information. We may check your details with fraud prevention agencies and if you provide false or inaccurate information or we suspect fraud, this information may be recorded. Fraud prevention agency records will be shared with other organisations to helpmake decisions on your creditworthiness, on motor, household, life and other insurance proposals, or claims for you and members of your household.

Sharing your information

-

The information we hold on you may be disclosed by us when legally required to do so at the request of government authorities conducting an investigation; and we use it to verify and enforce compliance with the policies governing our website and applicable laws or to protect against misuse or unauthorised use of our website. We may share your information with our collections partners including tracing agents and debt collectors.

Marketing

-

We, may use your information to inform you, by post, fax, telephone or other electronic means, about other products and services (including those of others) which we believe may be of interest to you unless you tell us not to. If you opt-in to receive third party marketing materials at the time of applying we may also pass your details to them.

-

You may opt-out of receiving marketing communications from us at any time by telephoning us on 0330 1200 313, by sending us an email to opt-out@1plus1loans.co.uk or by writing to us at the address provided above. You acknowledge that we may require a reasonable amount of time to process and action your request.

-

If you opt-out of our use of your data for marketing purposes, we will honour such choice once we have had a reasonable opportunity to process your request. We reserve the right to take reasonable steps to authenticate your identity with respect to any such request or other enquiry.

Miscellaneous information

-

Please write to us at our address stated above, or telephone us on 0330 1200 313 if you require details of the credit reference agencies or any other agencies from whom we obtain and to whom we pass on information about you. Under the Data Protection Act 1998, you have the right to receive a copy of the information we hold about you if you apply to us in writing. A small statutory fee will be payable.

-

Your data remains on file for six years after our files with your information are closed, whether settled by you or the Debtor or in default.

-

This is a condensed version of how we deal with your information. Further and fuller information is provided in our Privacy Policy, which is available on request or can be found on our website (www.1plus1loans.co.uk/privacy-policy) or by writing to us at our address stated above or by emailing us at info@1plus1loans.co.uk

How we are regulated

We are authorised and regulated by the Financial Conduct Authority, who are the supervisory authority under the Financial Services and Markets Act 2000 for credit businesses, with Firm Reference Number 717767. For more information please contact us.

Open Banking is a safe way for us to check some of your bank details, like how much money goes in and out of your account. This helps us see if you can afford the loan. We look at things like your income (money you earn), your regular spending, and any debts you have. We ask you to use Open Banking to make sure the loan is right for you.